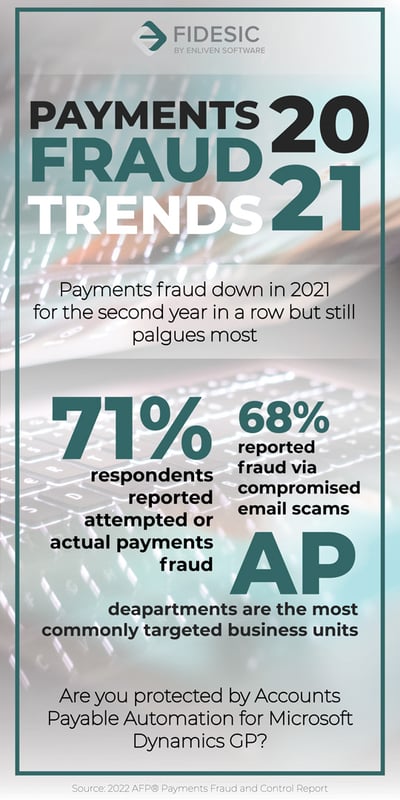

Payments Fraud Trends 2021

Payments Fraud is down for the second year in a row according to the latest survey results from the Association for Financial Professionals and JP Morgan. After spiking in 2018 and 2019, organizations reporting attempted or actual payments fraud decreased in 2020 to 74%, and again decreased in 2021 to 71%. While this decrease trend seems to be a good sign, the fact remains that more than ⅔ of businesses reported payments fraud in the last year and nearly ⅓ reported an increase in fraud incidents. In this post we will look at the common types of payments fraud and some of the ways businesses can protect themselves against them.

AP Department Fraud - Business Email Compromise

Business Email Compromise (BEC) remains a the most common method leveraged by malicious wrong doers to defraud accounts payable departments. About 68% of survey respondents said they were targeted by BEC in 2021. While this represents an 8% decrease compared to 2020, it is still all-to common, and accounts payable departments are the top target.

While treasury, C-suite, Human Resources and other business units are susceptible to some fraud, AP departments are the primary issuers of payments in most businesses, so it stands to reason they would be the top target for payments fraudsters.

As you probably guessed, BEC is a type of email-based fraud. According to the FBI website, BEC is usually perpetrated when a fraudster compromises a vendor’s email server and sends fake invoices with a fraudulent postal address, or an outside party sends an invoice impersonating a vendor with a reply-to email address and invoice that are deceptively similar to the actual vendor’s.

Other Common Methods of BEC Used by Fraudsters:

- Emails from third parties requesting bank changes, payments instruction, etc.

- Emails from fraudsters posing as senior executives requesting transfer of funds

Other Common Types of Payments Fraud:

- Outside check or credit card forgery

- Internal fraud of various methods

- Direct fraud from vendor or outsourced professional services firm

- Account Takeover – Malware, spyware, hacking etc.

Controls for Preventing and Containing BEC Payments Fraud

Because Paper Checks and ACH payments are the most common target for payments fraud (Checks 66%, ACH 37%), it is most important to secure these payment methods first.

Businesses can secure paper check payments with Positive Pay. With Positive Pay, banks only cash paper checks on a pre-approved basis. Learn More About Positive Pay.

Businesses can better secure ACH payments with the automation, ACH direct and Safe File Transfer Protocol. Learn more about how to Make ACH Safe.

Here are other important steps to take to secure payments against fraud:

- Implementing verification policies to check any changes to existing invoices, banking info and contact information

- Live confirmation– any requests for funds transfers checked by calling an authorized contact at the vendor

- Implement an approved contact list for vendors and not numbers listed in an email

- Strict internal controls around payments initiated by emails or other less secure messaging systems

- Require signatures from senior management payments over a specified threshold amount

- Strict user authentication and tracking to access network and payments initiation

How to Prevent Accounts Payable Fraud with AP Automation

With the right AP automation software, it is easy to implement the controls listed above to prevent BEC payments fraud. AP software can also help secure your payments against internal and external fraud in the following ways.

- Prevent false billing, fraudulent payments and reporting fraud by aligning security and payments teams on one solution with user-based approvals and time stamping for audit traceability/approvals tracking, as well as customizable workflow management controls.

- Prevent phishing and duplicate payments with built-in detection, prevention & security

- Reduce reporting fraud by integrating payments software directly with your accounting software to eliminate manual data entry.